In February 2014 the MASB announced that all private entities would be required to apply a single financial reporting framework the MPERS or such name as the Board may decide on 1. Private Entity Reporting Standards PERS This is the MASB approved accounting standards for all private entities.

Filing Requirements For Companies In Malaysia Quadrant Biz Solutions

This Alert discusses the Malaysian Private Entities Reporting Standards MPERS launched on 27 October 2015.

. The finalised standard follows a long consultation process including the issue. V Style of the document The text of MPERS preserves the format and structure of the International Financial Reporting Standard for Small and Medium-sized Entities IFRS for SMEs issued by the International Accounting. December 22 2020 Available online.

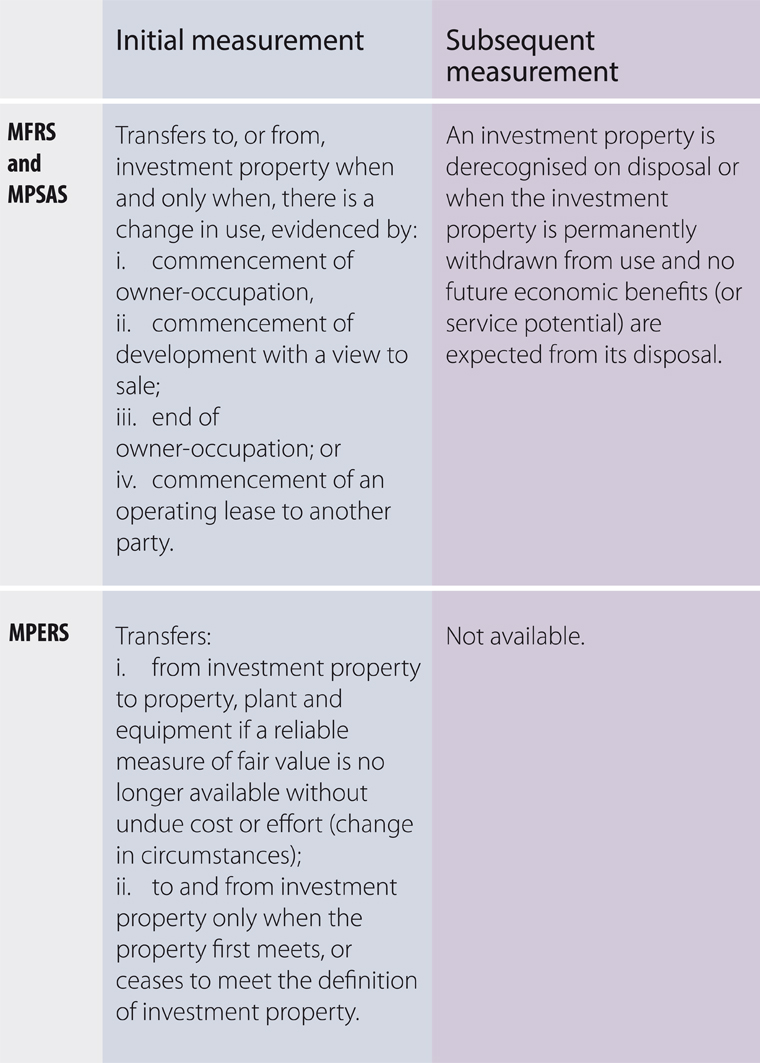

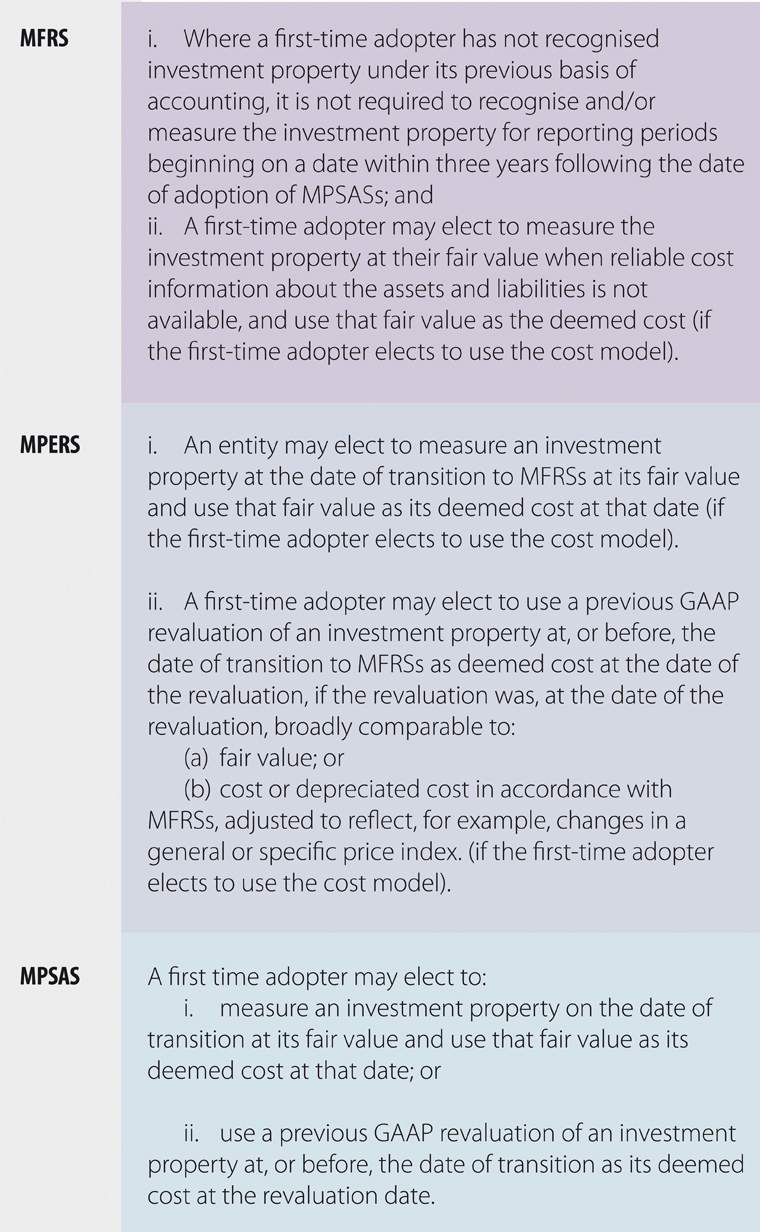

The qualification for first-time MPERS adoption is. Comparison between MPSAS MFRS and MPERS. However this has been withdrawn effective 1 January 2016.

One-stop up-to-date resource that contains all the relevant information you need to do your MPERS financial reporting. That all private entities would be required to apply a single financial reporting framework. In fact a private entity has the option to either adopt MPERS or Malaysia Financial Reporting Standard MFRS in its entirety.

Accounting questions and answers. Malaysian Private Entities Reporting Standard. 24052016 In February 2014 the MASB issued Malaysian Private Entities Reporting Standard MPERS and this sets a new milestone for financial reporting of private entities in Malaysia.

MPERS was officially launched on 27 October 2015 at Menara SSM by Tan Sri Azlan Zainol Chairman of Financial Reporting Foundation. And replacing the current PERS with the Malaysian Private Entities Reporting Standard MPERS the MPERS is based on the IFRS for SMEs with amendments in limited circumstances. In other words MPERS is to prepare.

MPERS is based substantially on the International Financial Reporting Standard for Small and Medium-sized Entities IFRS for SMEs issued by the IASB in July. 17 Feb 2014. However Malaysia has adopted its own version of the standard called Malaysian Private.

Which called Malaysia Private Entity Reporting Standard MPERS as mentioned by Zainol and Soon 2017. MASB - Malaysian Accounting Standards Board. Terms defined in the Glossary are in bold type the first time they appear in each section.

MALAYSIAN PRIVATE ENTITIES REPORTING STANDARD MPERS OUTREACH PROGRAMME Ipoh 14 Sep 2015 Seremban 12 Oct 2015 Bandaraya Melaka 13 Oct 2015 Kuantan 19 Oct 2015. They can choose to adopt Private Entity Reporting Standard PERS MPERS or the Malaysian Financial Reporting Standards MFRSs. The Malaysian Accounting Standards Board has issued Malaysian Private Entities Reporting Standard MPERS for use by private entities.

A reference for local accounting and reporting practices because the examples provided include some of the latest issues and trends in private entity reporting. In Malaysia IFRS for SMEs is adopted with the name of Malaysian Private Entities Reporting Standard MPERS. EXECUTIVE SUMMARY 1 MPERS requires.

The framework which is effective 1st January 2016 was issued by the Malaysian Accounting Standards Board MASB on Feb 14 2014 to replace the outdated Private Entity Reporting Standard PERS which had been in force since 1998. It is expected that not less than 35 countries including Malaysia will adopt this standard. December 28 2020 Malaysian Private Entity Reporting Standard MPERS serves as new reporting framework to private entities and significant milestone to the capital market.

November 28 2020 Accepted. MPERS gives the increasing prominence of local private entities and small and medium-sized enterprises SMEs in the regional and global markets. The introduction of the Malaysian Private Entities Reporting Standard MPERS in January 2016 is timely and vital.

They have a choice of continuing with the existing Private Entity Reporting Standards PERS Framework or apply the. Malaysian Private Entities Reporting Standards MPERS. Malaysian Private Entities Reporting Standard The Malaysian Private Entities Reporting Standard MPERS is set out in Sections 1-35 and the Glossary.

This article analyses the accounting treatment for intangible assets under Malaysian Public Sector Accounting Standard MPSAS 31 Malaysian Financial Reporting Standard MFRS 138 and Section 18 of Malaysian Private Entities Reporting Standard MPERS. Previously SME companies refer to the Private Entity Reporting Standard PERS which is considered outdated as it was. The MPERS is based on the IFRS for SMEs as issued by the IASB in July 2009 with some limited amendments.

The private entities in Malaysia have three options to use or apply the accounting standard. It highlights some of the key differences with the Malaysian Financial Reporting Standards MFRS and the Private Entities Reporting Standards PERS and analyses the key principles upon first-time adoption of the MPERS. Misconception is that by default the adoption of MPERS is the only choice for private entities.

The MPERS is accompanied by a preface. October 28 2020 Received in revised format. However there are certain differences and ame ndments with the.

The International Accounting Standard Board IASB on 9th July 2009 had released the International Financial Reporting Standard IFRS to be adopted by Small Medium Enterprises SMEs. Malaysian Private Entities Reporting Standard MPERS is issued by the MASB in respect of its application in Malaysia. On 14 February 2014 the Malaysian Accounting Standards Board MASB issued the Malaysian Private Entities Reporting Standard MPERS to replace the old Private Entity Reporting Standards PERS.

The Malaysian Financial Reporting Standards MFRS This is the MASB approved accounting standards for entities but this does not include private entities.

An Idiot S Guide To Accounting Standards In Malaysia

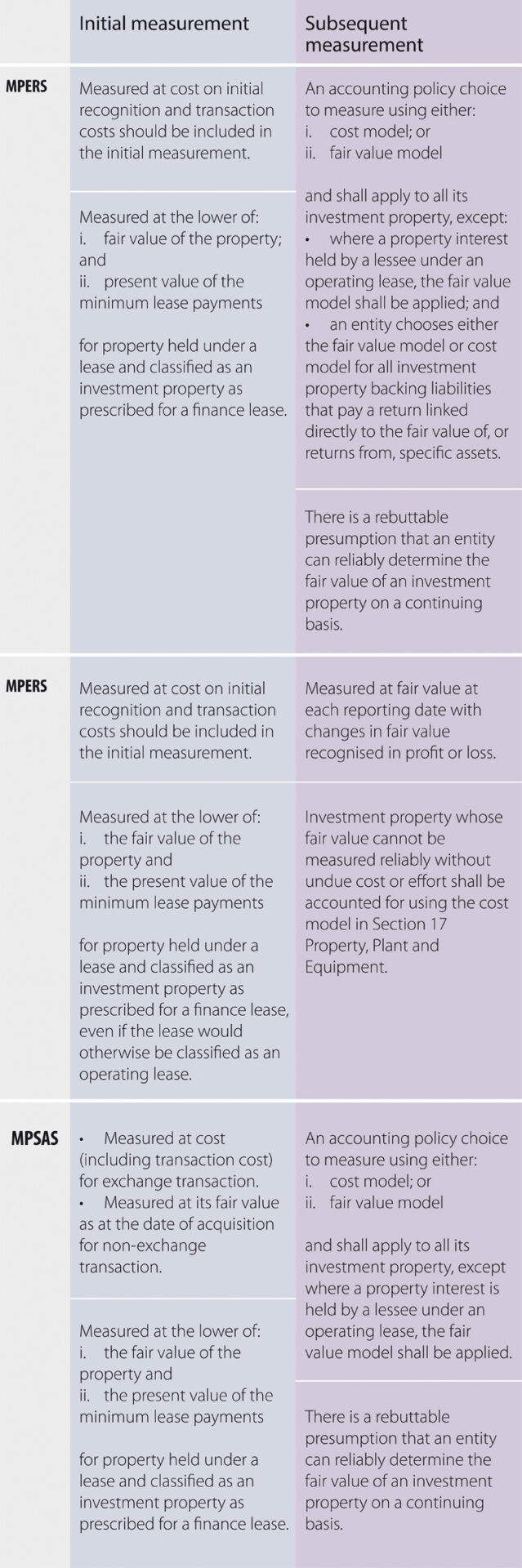

Comparison Between Mpsas Mpers And Mfrs Investment Property Accountants Today Malaysian Institute Of Accountants Mia

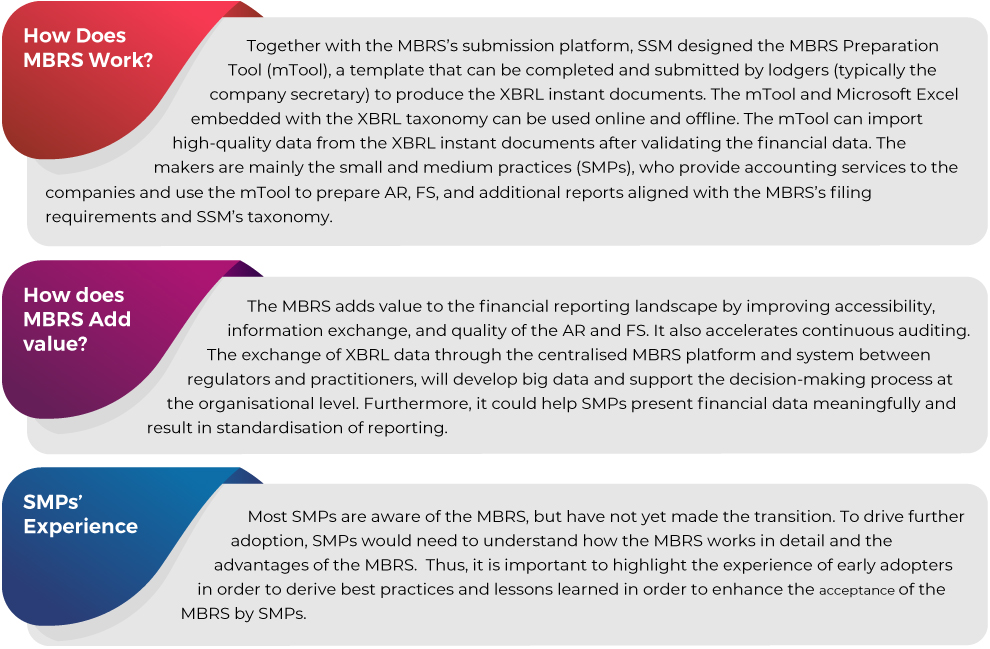

Xbrl Adoption In Malaysia A Way Forward For Smps Accountants Today Malaysian Institute Of Accountants Mia

Wolters Kluwer Malaysia Cch Books Tax Books

Xbrl Adoption In Malaysia A Way Forward For Smps Accountants Today Malaysian Institute Of Accountants Mia

Malaysian Business Reporting System Mbrs

Covid 19 Revised Deadlines For Annual Report Submissions And Key Challenges In Financial Reporting For Listed Companies Accountants Today Malaysian Institute Of Accountants Mia

How Will Mfrs 15 And 16 Affect Tax Reporting Accountants Today Malaysian Institute Of Accountants Mia

An Idiot S Guide To Accounting Standards In Malaysia

Comparison Between Mpsas Mpers And Mfrs Investment Property Accountants Today Malaysian Institute Of Accountants Mia

Less Complex Entities Lce Standard A Panacea For A Cost Effective Audit Accountants Today Malaysian Institute Of Accountants Mia

Comparison Between Mpsas Mpers And Mfrs Investment Property Accountants Today Malaysian Institute Of Accountants Mia

Filing Requirements For Companies In Malaysia Quadrant Biz Solutions

Comparison Between Mpsas Mpers And Mfrs Investment Property Accountants Today Malaysian Institute Of Accountants Mia

Pdf An Investigation Of The Level Of Compliance With Financial Reporting Standards Frs 101 By Malaysian Smes

An Idiot S Guide To Accounting Standards In Malaysia

Batch 1 Working Papers On The European Sustainability Reporting Standards Have Already Been Released